tax credit college student

For your 2021 taxes which you file in. Its not an education tax credit exclusively for college students but general learning credit for lifetime learners.

Taxes 2021 Credits Deductions And Tax Breaks For Student Loans And College Costs Cashay

Colleges and universities and more.

. Only for the first four years at an eligible college or vocational school. Qualifying students can receive credits of up to 2500 per year. If you made 600 or more at work last year your employer must provide.

The American opportunity tax credit is. College tax credits and other education-related tax breaks could save students and parents thousands of dollars. Download and complete this form to see if you qualify for tax credits for college students.

The American opportunity tax credit is. If you are a self-declared college student you can claim this credit up to four times. Worth a maximum benefit of up to 2500 per eligible student.

The Bloomfield New Jersey campus for Bloomfield College is located in a Suburb setting see the map below. American Opportunity Tax Credit This credit can be worth up to 2500 per year for four years of schooling after high school if enrolled at least half-time and working towards a degree. It is reimbursable for up to 1000.

Here are some specifics. Visit our Income Tax Guide for College Students and find out about student IRS forms that can be filed for free. One useful tax break for college graduates and their parents is the student loan interest deduction.

The AOTC is a tax credit of up to 2500 per year for an eligible student. Total enrollment for all degrees including nursing programs is 1685. Each student for which you claim the credit must have been enrolled at least half-time for at least one academic period which began during the 2021 Tax Year when filing in 2021.

You can claim the. Only available for the first four years at a post-secondary or vocational. The American Opportunity Credit allows you to claim up to 2500 per student per year for the first four years of school as the student works toward a degree or similar credential.

Worth a maximum benefit up to 2500 per eligible student. Fairleigh Dickinson University has articulation agreements with all New Jersey county and community colleges. The Complete College America CCA 15 to Finish initiative seeks to fix this issue by encouraging academic credit momentum at US.

A tax credit is a dollar-for-dollar refund of the amount you are donating. Mercer County Community College 1200 Old Trenton Rd West Windsor NJ 08550-3407 609 586-4800. Prospective county and community college transfer students are.

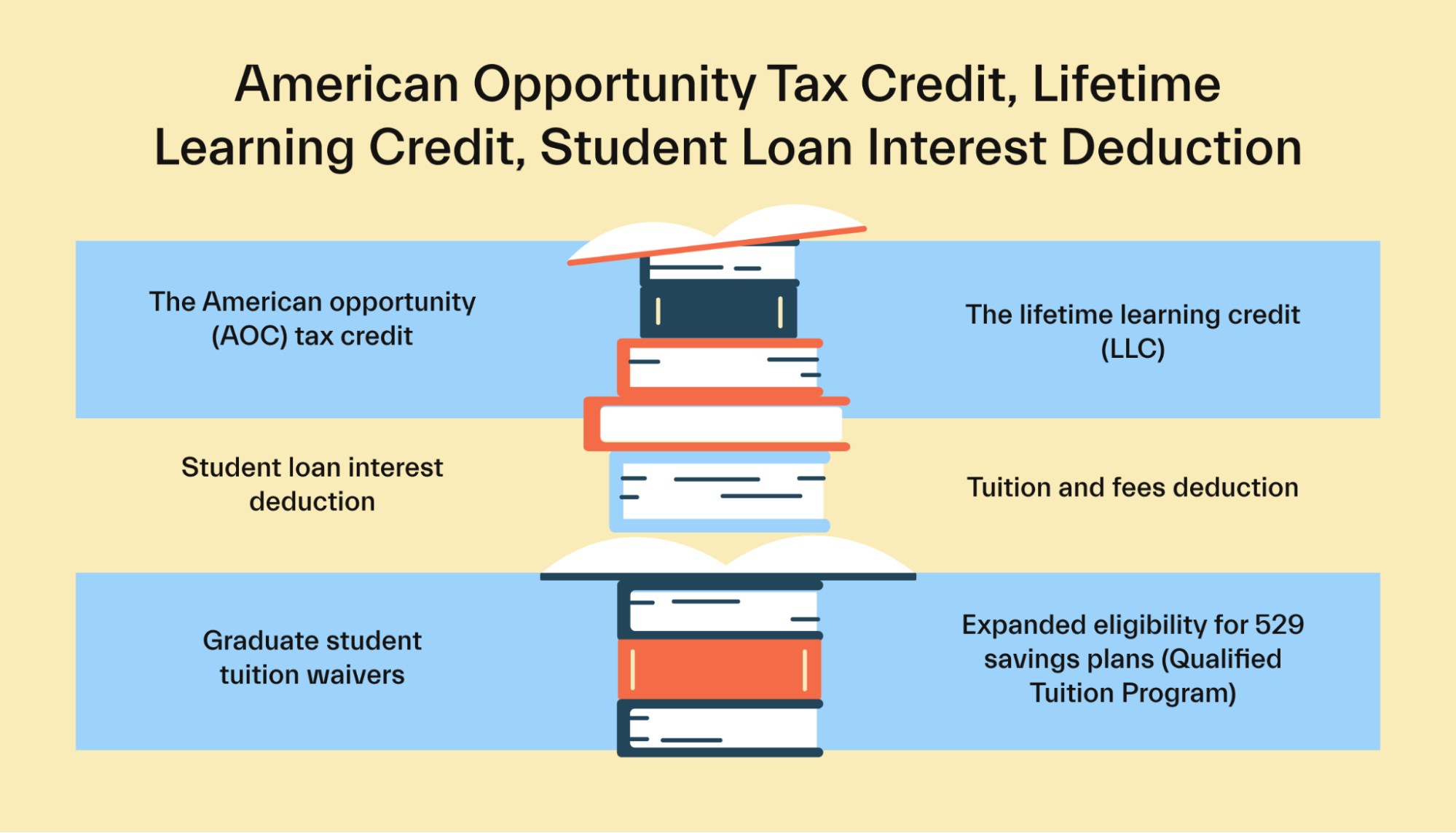

The credit covers 100 of the first 2000 in approved expenses and 25 of the second 2000 in expenses. American Opportunity Tax Credit. The Student Loan Interest Deduction.

Here are some college tax breaks to know. The Arizona Kids Tax Credit Program allows every Arizona income tax-payer to contribute to an Arizona Public. A tax credit reduces the amount of tax you owe.

Apply to Food Service Worker Physical Therapy Aide Student Assistant and more. It allows a credit of 20 of the. As a college student you can take advantage of tax credits and tax deductionsand these are not the same thing.

Understanding Irs Form 8863 Do I Qualify For American Opportunity Credit The Handy Tax Guy

3 Tax Breaks For College Students You Can T Afford To Miss Saint Leo University

Is College Tuition Tax Deductible Yes It Can Be

Tax Credit Scholarship Program Support Ctk Christ The King Jesuit College Preparatory School

Tax Benefits For College Students Credit Union Student Choice

Teens Taxes I Received A Child Tax Credit For My College Student Do They Need To File Taxes Gobankingrates

6 Tax Breaks For College Costs Kiplinger

2022 College Tuition Tax Deductions Smartasset

3 Best Tax Deductions For Parents Of College Students

College Tuition Tax Credit A Consolation Prize To Tuition Bills

College Tuition Tax Credit A Consolation Prize To Tuition Bills

Paying For College Are Scholarships Taxable Charles Schwab

College Guide For Parents Thestreet

What Is The American Opportunity Tax Credit The Motley Fool

What Is The American Opportunity Tax Credit And How Much Can I Get The Us Sun

Everything You Need To Know About College Tax Credits

2022 College Tuition Tax Deductions Smartasset

College Education Tax Credit For Students In Colorado 2021 Tax Update

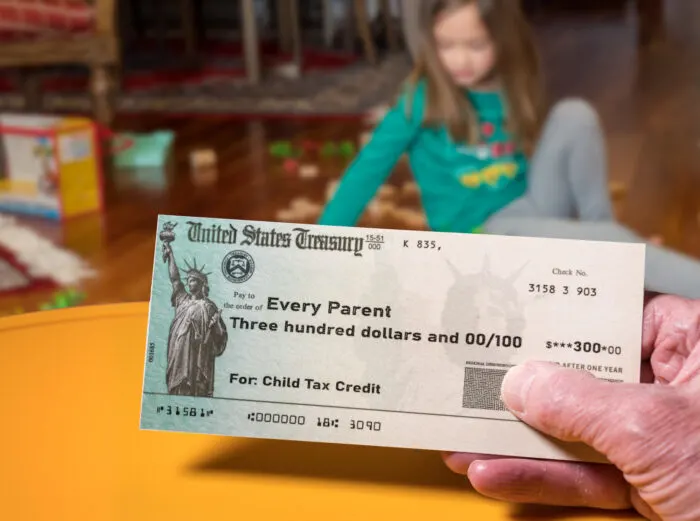

Have A College Student You May Be Getting A 500 Payment Next Month